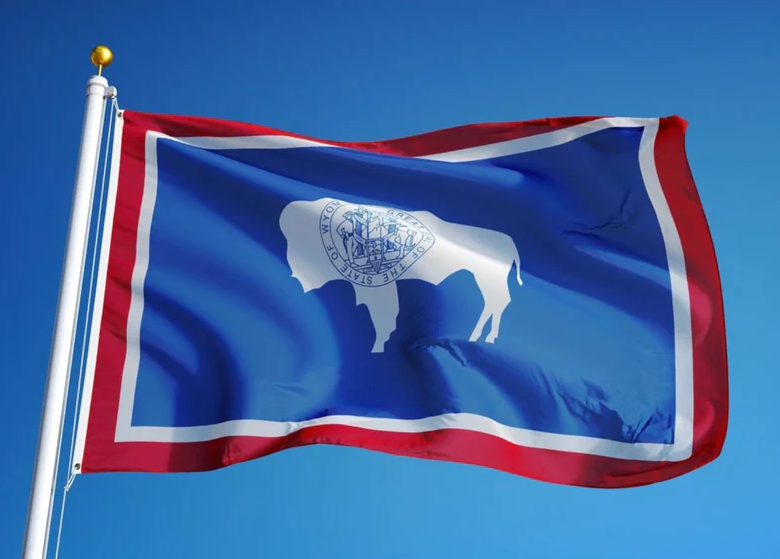

Casper, WY – State officials said that the Bureau of Land Management estimated the overall lease sale netted $14.7 million in Wyoming, approximately $1.8M more than the 2022 sale. Initially, over 250,000 acres were proposed.

However, that number was reduced to just over 127,000 acres–a drastic reduction in available acres for leasing bids.

Forty-nine parcels did not receive any bids. In prior years, many of these parcels could have been sold through the noncompetitive bid process, providing additional revenue for the state.

Without this program, the state does not receive any income.

The higher mandatory fees required by the Inflation Reduction Act mean higher fuel prices at the pump.

Since Wyoming receives 48 percent of royalty rates, bonus bids and rental payments, the State will receive more revenue due to the increased federal fees, which comes at a cost to consumers and the oil and gas economy.

The Wyoming oil and gas industry has yet to regain the number of drilling rigs or employees it had in 2019. The number of drilling rigs for 2023 has hovered around 20, slightly more than half of the number in 2019.

This sale shows that the onerous federal requirements contribute to the slow recovery. Gas production continues to decline.